Helping youths through the minefields of financial planning

April 27, 2022

The world of financial literacy has evolved, making our relationship with money more complicated. During COVID-19, many have also been struggling financially, with the hardest hit coming from the low-income demographic.

This is where Chemistry alumna Ruth TEO from the Faculty of Science comes in. Together with alumnae Maya IBRAHIM from the Faculty of Arts and Social Sciences (FASS) and Cheryl ANG from NUS Business School, Ruth co-founded Money&Me, a ground-up financial literacy programme for youths.

The co-founders believe that many money problems can be avoided if financial literacy is taught earlier. This knowledge creates a foundation for youths to build positive money habits for financial stability and avoid mistakes that could lead to a life’s worth of money struggles.

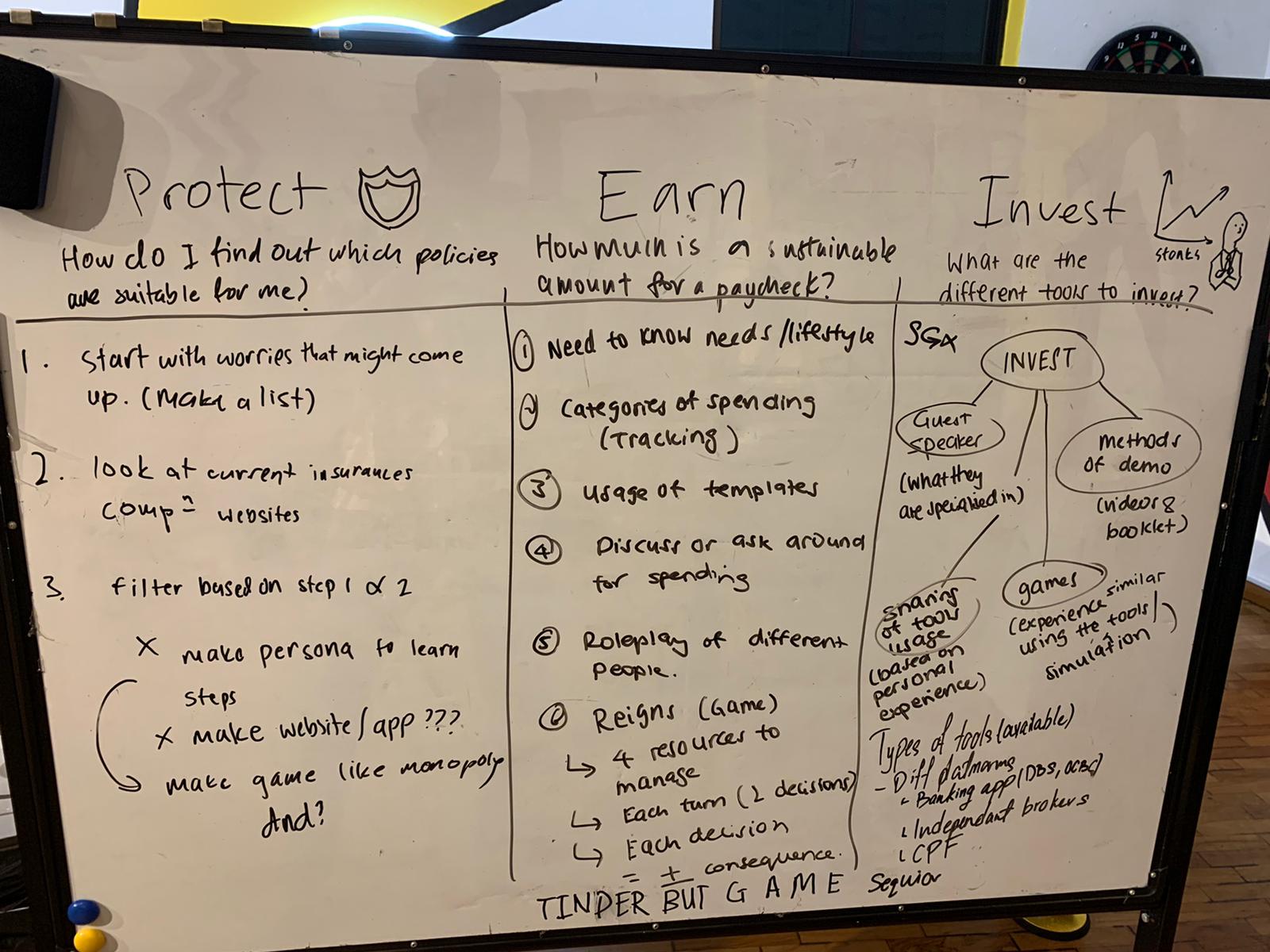

Money&Me seeks to co-create solutions for youths, while also recognising that the youths themselves are assets holding the answers to solving community problems. The team developed a six-week programme, comprising workshops and small group mentoring sessions on different themes such as saving, spending, earning, borrowing, insurance and investing. At these sessions, participants learnt to contextualise and apply the knowledge to their own goals.

Maya says, “We want to build safe spaces where young people can ask questions and learn skills to help them make better financial decisions…we believe that we can make a difference in more people’s lives.”

The team relied on their pool of interdisciplinary skills and knowledge to bring this initiative to pass. For instance, Maya sought advice from FASS professors on how to frame questions and collect meaningful data during focus group discussions, while Ruth drew on her research knowledge and insights on market validation from her participation in the NUS Overseas Colleges (NOC) programme.

While the team had started the programme as part of NUS’ Resilience and Growth (R&G) Innovation Challenge, they soon realised the positive impact of Money&Me and plan to upscale this initiative.

With this in mind, the team took part in Season Three of the Youth Action Challenge, receiving additional grant funding to run more editions of the workshop and to develop a card game to generate more conversations about money.

Ruth says, “The content of the programme exceeded expectations in terms of how holistic the topics were…the greatest highlight is seeing how the youths benefitted from the programme.”

Moving forward, Money&Me hopes to secure more partnerships with Institutes of Higher Learning (IHLs) and social service organisations, so as to reach out to more youths from various backgrounds.